The Ozempic Effect

How weight-loss medications are transforming luxury consumption and scent preferences.

Is it possible that we’re learning to spray our cravings instead of chewing them? As GLP-1 drugs like Ozempic curb physical appetite, something curious is happening. NielsenIQ reports that users of these medications buy 23% more perfume than everyone else.

Appetite may be shrinking, but the desire for indulgence hasn’t gone away. It has simply found a new outlet. Fragrance becomes a proxy for pleasure, where a spritz of vanilla offers the satisfaction of a treat, the comfort of ritual and the spark of dopamine.

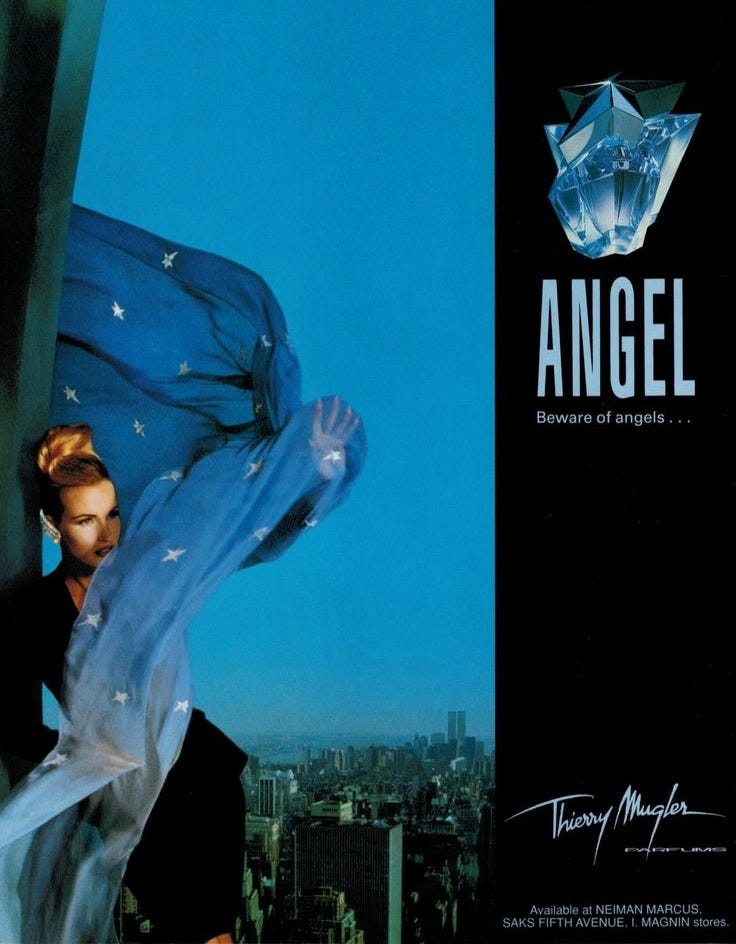

But our craving for sweetness in scent isn’t new. Shalimar made vanilla glamorous, thanks to ethylvanillin, a synthetic note three times stronger than natural vanilla. Then, Angel rewrote the rules entirely.

Angel's Sweet Disruption

Released in 1992, Thierry Mugler’s Angel wasn’t just a departure from the trends of its time, it defined a whole new category. While bestsellers like L’Eau d’Issey and Acqua di Giò were embracing airy, ozonic freshness (a movement I profiled for Vogue), Angel introduced Gourmand to the fragrance world. Anchored by ethyl maltol, a cotton-candy-sweet cousin of vanilla, it marked a radical shift.

Francis Kurkdjian notes it was formulated with just 0.3% of the molecule, while today perfumers often go ten times higher. As with ultra-processed foods, our sensory tolerance for sweetness has climbed, resetting what “normal” smells like.

Food as Status Symbol

Edible cues are luxury’s new shorthand. Saint Laurent lookbook stages a chic picnic, Jacquemus sends butter-on-toast viral and Loewe elevates tomatoes to objets d’art. Hospitality follows suit: Ralph’s Café inspired a wave of label cafés—Louis Vuitton, Prada, Gucci where posting the cup matters as much as drinking it. The same goes for pop-up brand activation where Chanel opened a Chance Dinner in Brooklyn or Diptyque staged a gelato pop-up in Seoul, offering frozen treats inspired by its newest fragrances. The strategy pays-off: Maison Margiela’s madeleine-scented Brooklyn pop-up drove Replica sales up 400%.

This is tied to the “small pleasures” trend: $20 celebrity smoothies, $60 chips, even a $250 watermelon. When a handbag feels out of reach, bite-size luxury food and croissant fragrances let consumers showcase taste, privilege and cultural fluency. Food is transforming from fuel to status you can spray.

Redirecting Desire

As food-inspired beauty peaks, our relationship with actual food is shifting. PwC estimates that 8 to 10% of U.S. adults are now on a weight-loss GLP-1. Carat’s Generation GLP-1 study (2025) shows 40% of users now spend more on beauty while dining-out tops the cut-back list. GLP-1 drugs and the broader Make America Healthy Again mood vilifying sugar, dyes and ultra-processed fare, have pushed culture from body-positivity to body-optimization.

Two mechanisms explain how fragrance benefits from this macro-shift:

Satiety via scent: A 2023 Nature Metabolism paper showed that in lean mice, smelling food activated a brain circuit that signaled rapid fullness and reduced intake, suggesting scent may help curb appetite.

Confidence dividend: When GLP-1 users hit weight-loss goals, new self-esteem flows straight into appearance upgrades. Carat notes that fashion and beauty (including fragrance) are the first categories to see a spend uplift.

In that context, Gourmand fragrances are the perfect loophole: the crème brûlée dopamine hit with zero calories or moral panic. It’s an indulgence you can wear, not eat.

The Evolution to Neo-Gourmand

Gourmand fragrances are now part of the mainstream. For example, Sol de Janeiro, known for its nutty, vanilla, creamy scents, topped Sephora’s US sales in 2024, dethroning Rare Beauty. As sweetness saturates the market, perfumers are evolving toward “Neo-Gourmands”, scents that remain edible but are less sugary and balanced with savory or green nuances.

Tomato-leaf & basil: farmers’-market freshness instead of frosting.

Pistachio-salt or roasted-sesame milks: nutty richness without the sugar rush.

Caviar, miso and butter: savory, rich, and unexpected twists

As the line between food and fragrance blurs, several brands are taking the concept literally:

Salt & Straw “Culinary Perfumes”: food-safe sprays that top ice-cream and double as lickable body mists

DedCool × Erewhon: the brand's Milk scent, reimagined as a vegan smoothie

H-THEORIA: small-batch liqueurs that turn perfumery storytelling into drinkable form

The line between what we spray and what we sip is dissolving, one tomato leaf, waffle-cone spritz, and perfumed nightcap at a time.

What Comes After Sweet?

If the ’90s showed that perfume could taste like candy, the 2020s prove it can feel like a full meal. Sugar is disappearing from plates and GLP-1s are shrinking appetites, so scent has become the safest place for indulgence. Angel’s cotton candy has grown into pistachio-salt milk, caviar accords and tomato-leaf tonics that keep dopamine high but calories low.

The next Gourmand stars will not just add more ethyl maltol, they will juggle texture, temperature and contrast, turning the fragrance lab into a test kitchen where perfumers borrow freely from chefs.

Yet history reminds us that saturation leads to pivot. Angel zigged when the ’90s were swimming in ozone and now every brand is riding a sugar high. Today, with nearly every brand indulging in food, the next breakthrough may not be a twist on Gourmand, but a complete reinvention of what desire smells like.

That was SO interesting. Love a deep dive backed by numbers, not just vibes.