Pop Niche: The Blurring Lines of Fragrance Creativity

The Tension Between Creativity and Profit

"The term 'niche' has been hijacked, transformed into a marketing buzzword" argues founder Thomas De Monaco, in a recent article. This observation highlights the shift in how we define niche perfumery today. But to understand how we got here, we need to look back at how niche fragrances started and how they have evolved.

The Rise of Niche Perfumery

Niche fragrances began as a rebellion against mainstream perfumery, prioritizing artistry over trends.

Designer brands chased broad appeal with focus group-tested fragrances, massive ad campaigns and a global department store distribution. Niche houses, by contrast, prioritized individuality and artistic expression, carving out a loyal following.

A pivotal moment came in 1992 with Serge Lutens' Féminité du Bois, a fragrance that broke convention and inspired a new generation of perfumers to craft scents driven by personal expression rather than market trends. For early adopters, wearing niche fragrances wasn’t about following trends but reconnecting with artisanship, embracing individuality, and seeking out the thrill of discovery.

As niche fragrances evolved from a marginal rebellion in the 1990s and early 2000s, the COVID-19 pandemic became a pivotal catalyst. Locked down consumers sought personal experiences through fragrance, transforming niche perfumery from an insider's market into a global conversation about olfactory artistry with passionate collectors and dedicated boutiques.

The Evolution of Niche Perfumery

Four core principles once set niche apart, shaping both its business model and creative approach:

Over time, these principles softened as niche brands expanded and mainstream houses adopted niche approaches to their own portfolios.

The Prestige Landscape and the Niche Challenge

Prestige brands—established luxury brands, premium pricing and a long-standing reputation—didn't ignore the niche movement. Instead, they created their own exclusive collections that mirrored niche principles while leveraging their own heritage. Armani must have been the fist in 2006 with Armani Privé, creating a template that many would then follow—from Dior to Tom Ford, with Bottega Veneta being one of the most recent entrants—all crafting collections that blurred the line between niche and prestige.

While prestige brands were creating exclusive collections that borrowed niche principles, major beauty conglomerates began to see independent fragrance houses not as competitors, but as valuable acquisition targets.

The Mainstreaming of Niche

As niche brands gained popularity, established players found another way to stay competitive—by acquiring them. Major beauty conglomerates began adding independent houses to their portfolios, blending niche credibility with corporate scale:

Estée Lauder acquired By Kilian, Le Labo and Frédéric Malle.

LVMH acquired Officine Universelle Buly and Maison Francis Kurkdjian

PUIG added Byredo to its portfolio.

L’Oréal bought Atelier Cologne.

Kering purchased Creed and later invested in Matière Première.

These acquisitions reflect a broader market trend: niche fragrances are not just a passing fad, but a robust segment valued at $2.4 billion and projected to grow at a 14.5% CAGR until 2032. What was once an insider's market transformed into a sector driven by strategic growth, increased distribution and expanded marketing efforts, gradually diluting the exclusivity that initially defined these brands.

And as the market and players evolved, the distinction between niche and prestige became increasingly blurred, creating a third segment that sits between true niche and prestige - Pop Niche.

Niche: True indie brands with limited distribution, creative autonomy, and high artistic value.

Pop Niche: Brands that were once niche and reached popularity or brands borrowing niche codes but widely available

Prestige: Established brands with broad distribution, mass appeal, and heavy advertising

Does Independence Matter?

This fuels an ongoing debate on #perfumetok, where fragrance aficionados argue whether a brand can stay niche after being acquired. Many assume corporate ownership stifles creativity, yet history suggests otherwise. Serge Lutens, for example, was backed by Shiseido from it’s inception and produced some of the most avant-garde scents in perfumery.

This reveals that independence isn’t just about ownership—it’s about creative control. Some acquired brands continue pushing boundaries, while others shift towards commercial viability to justify expansion. The real question isn’t whether a brand is independent but whether it stays true to its creative ethos.

The Natural Evolution of Niche

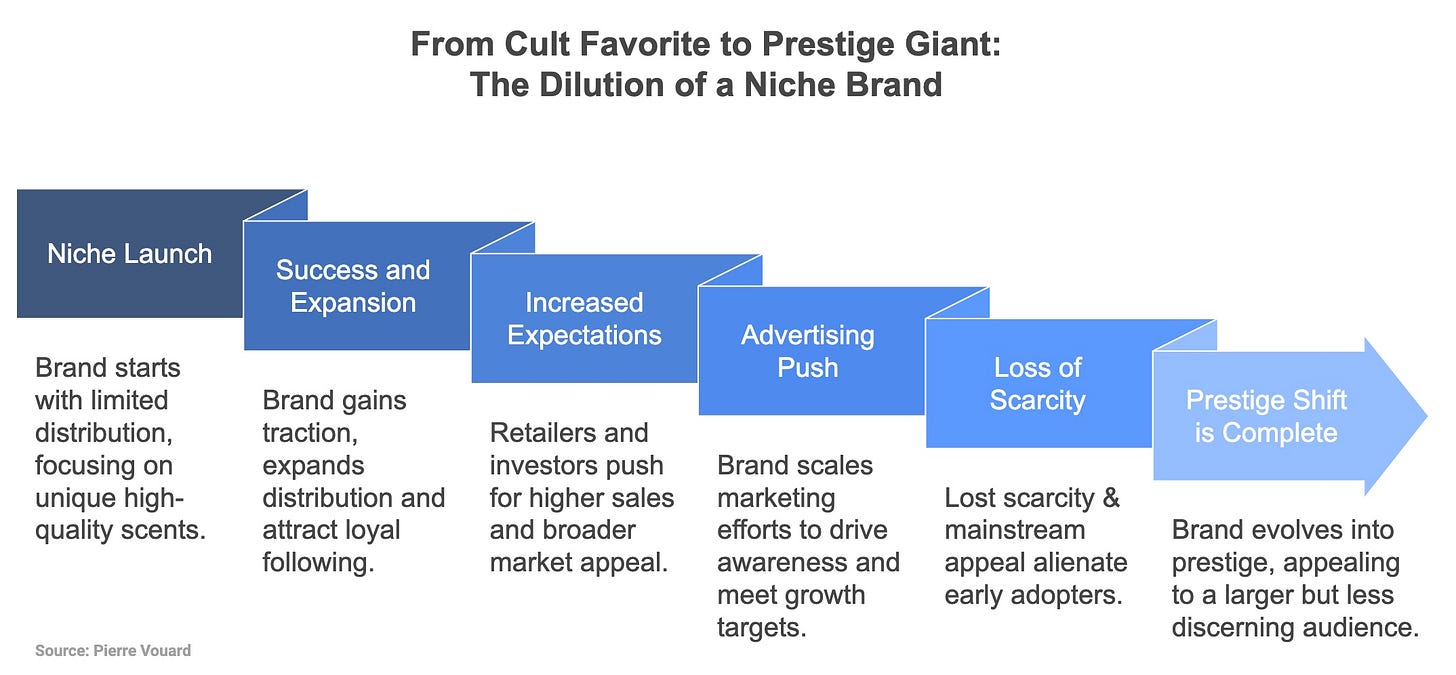

For purists, the erosion of niche’s exclusivity feels inevitable. As brands scale, they face a crossroads: resist commercialization or embrace it for growth.

As niche perfumery evolves, it stands at a fascinating crossroads. In part 2, we will explore how the boundaries between indie creativity and mass appeal are dissolving, giving rise to what we've identified as 'Pop Niche' – a dynamic space where artistic expression meets commercial accessibility. We'll dive deeper into this new paradigm: What defines 'cool' in an era where scene cool and internet cool collide? From Sephora's impact on discovery to evolving marketing strategies, we'll unpack how niche perfumery is being reinvented for a new generation – proving that the spirit of innovation remains the true essence of fragrance, regardless of how we define its boundaries.

[To be continued in Part 2: "Breaking the Mold: Niche Perfumery's Evolution" where we’ll explore how brands are adapting to this new reality and what the future holds for niche perfumery.]

So fascinating! A question that people ask me is what is the difference between niche and indie. I don't have a good answer for that yet.

Interesting article.